Why Choose Us for Onfido SDK Integration?

Our team has built user verification and identification applications for various clients for many years. Whenever a client wants Onfido SDK integration, we understand their needs and provide a custom solution.

-

We have developers who have integrated the Onfido SDK into real-world apps. -

We don't just stop at integration, but also do security, testing, and performance optimization.

Proven Expertise

Our developers have extensive hands-on experience in implementing Onfido SDKs across mobile and web platforms.

Customized Solutions

We adapt Onfido’s verification flows to align with your specific compliance and user experience needs.

Scalable Architecture

From digital-first startups to large enterprises, we deliver solutions that scale effortlessly.

End-to-End Support

We provide complete support—from integration, testing, and deployment to post-launch optimization.

Security & Compliance

We prioritize data security and ensure alignment with regulations like GDPR, AML, and KYC standards.

How We Integrate Onfido SDK

Integrating the Onfido SDK is straightforward but requires attention to detail. Our approach is step-by-step.

Our integration process starts with a deep understanding of your business objectives, compliance requirements, and platform setup. Once we have a clear ui, our team seamlessly integrates the Onfido SDK into your mobile or web applications, ensuring compatibility and smooth performance.

We then customize workflows to match your verification needs, whether it involves document verification, biometric authentication, or video-based checks. After implementation, we conduct thorough testing and optimization to ensure accuracy, security, and an exceptional user experience. Finally, we handle deployment and provide continuous support to keep your solution up-to-date and reliable.

Requirement Analysis

First, we understand the client’s requirements, whether the app is Android, iOS, web, or cross-platform. The Onfido SDK is modular, allowing you to choose only the features you need, such as document capture or face verification.

Onfido SDK Setup

Starting with testing in the Sandbox and Test Environment.

Data Security

Handling user documents and photo data in a secure manner.

User Flow Integration

Adding a verification process as per UI/UX in the app. Face Matching and Document Verification Proper use of Onfido SDK features.

Testing and Debugging

Testing different edge cases, failed verifications, and network conditions. Live Deployment – Release in a fully secured and stable environment.

Hire an Expert Onfido SDK Integration Developer

If you need a dedicated developer, hire from our team. Our developers are Onfido experts with extensive project experience. You can hire them full-time, part-time, or on a project basis. Our team handles real-time validation, such as during document uploads, and sets up multi-language support to ensure the app works seamlessly for global users.

If problems arise, such as permissions issues, they provide quick fixes. Our rates are competitive, and we sign contracts with NDAs.

To hire, contact us today. We’ll share resumes and arrange interviews. It’s simple—tell us what you need, and we’ll provide it.

Contact us today!AML Software for Banks: 4 Features to Look For

When compliance leaders at a bank choose AML software, they should prioritize features that enhance fraud detection efficiency, regulatory compliance, and reporting capabilities. The right solution should simplify operations, reduce false positives, and minimize integration problems.

Data Quality

Breadth, depth, and timeliness of AML data sources and update mechanisms.

Use of AI

Practical use cases like improving efficiency, prioritizing high-risk alerts, and mapping network risks.

Integrated Fraud + AML Approach

Unifying fraud and AML detection for better efficiency and risk detection.

Regulatory Agility

Ability to adapt quickly to new fraud typologies, real-time payments, and evolving compliance needs.

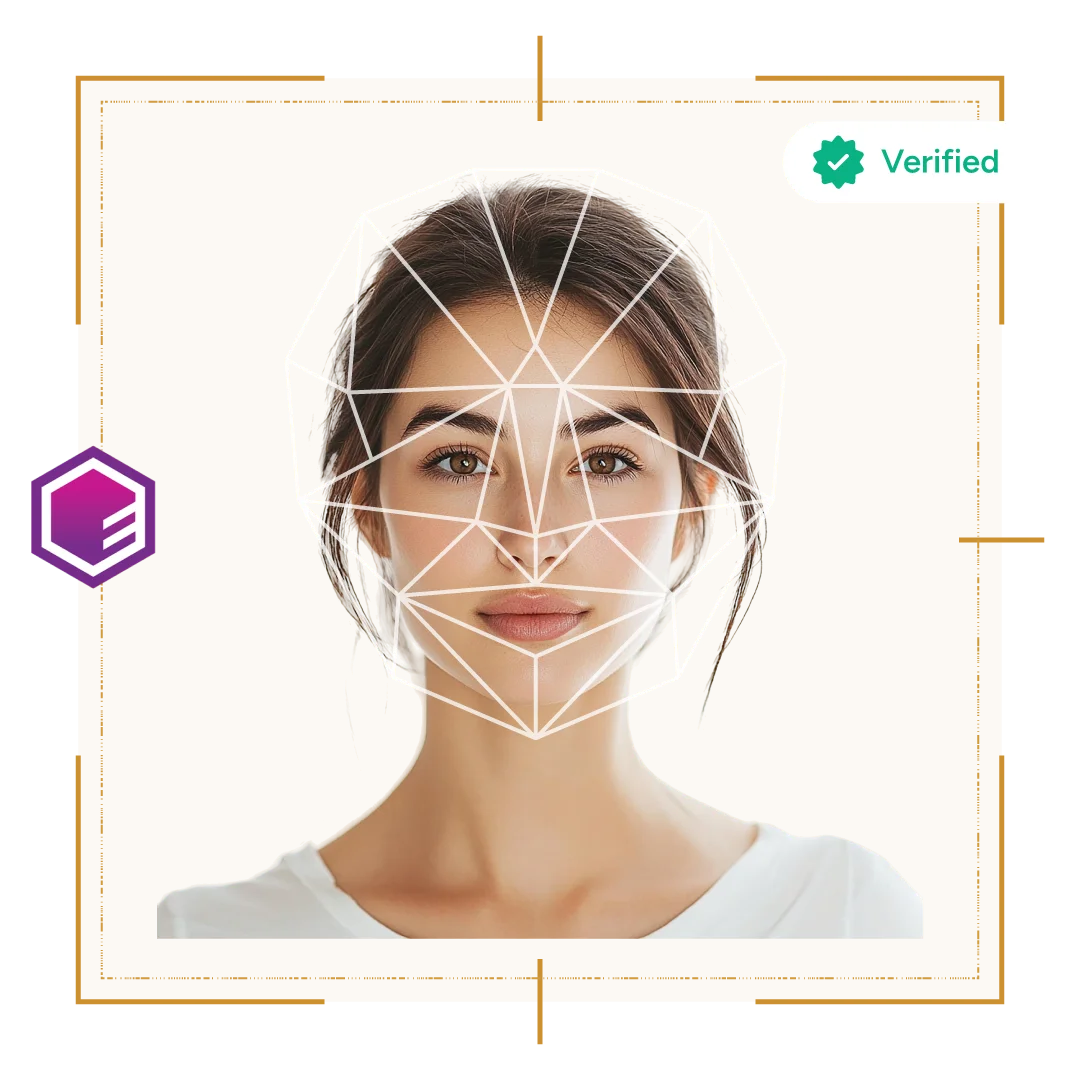

Onfido SDK Features We Implement

Onfido offers many features, and we can integrate any of them into a mobile or web app. Here, we will discuss some of the top features that may suit your needs.

Document Verification

User uploads passport, driving license, and AI will check. We set it up with 99% accuracy.

Biometric Verification & Face matching

Match the user's photo with the ID. Liveness check, verifying if it’s a real person or just a photo, helps prevent fraud effectively. We ensure it works smoothly in the app without long wait times.

Motion Capture

User moves head, like turning their head. It catches bots. We don't gamify it, just keep it simple.

Address Verification

Address proof check if needed. We make it optional.

Workflow Customization

Customize Onfido's workflows. Like, first document, then biometrics. We control it with the API.

Reporting and Analytics

After integration, dashboard setup. How many users were verified? What is the fail rate? We connect it to your system.

Implementing these features enhances your app’s security. Whether it’s a financial app, healthcare platform, or stock trading app—anywhere KYC is required. We cover it all.

Two Live Projects

Featuring Onfido Integration

We have delivered secure, compliant, and scalable solutions for leading industries worldwide.

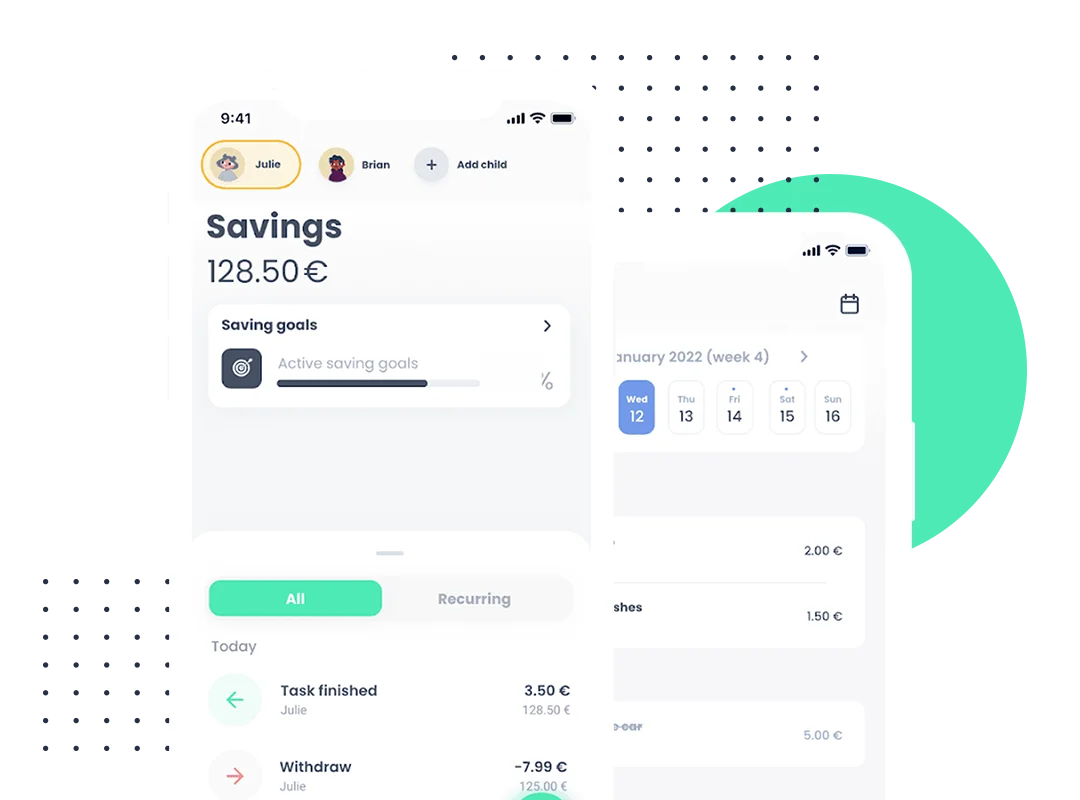

Loan Application

First, for a fintech startup, we worked on a loan application app where users had to complete KYC. We integrated the Onfido SDK into both the Android and iOS versions of the app.

First, we implemented document verification, followed by face scanning. The backend was built on Node.js, which made API integration straightforward.

In testing, we tried 100 fake cases, and all were caught. The client was happy because the verification time became less than 2 minutes. Earlier it was manual, now it's auto.

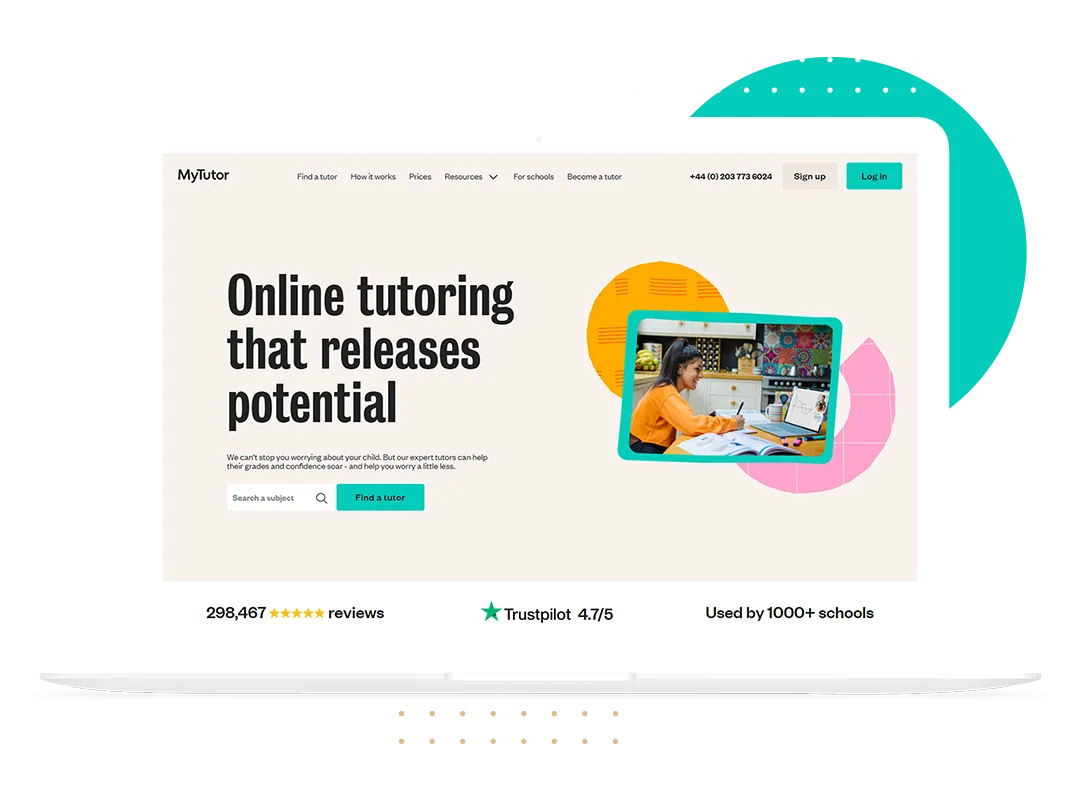

E-learning platform

For a US-based startup, we integrated Onfido into their app, where users had to verify their ID for certification.

We used Onfido's Web SDK in the web app, with a React frontend and Python backend. Implemented features included biometric verification and document validation.

A special feature we added was Spanish language support. During testing, we ensured browser compatibility across Chrome, Safari, and others.

There was an issue with camera access on mobile devices, which we resolved. The client commented, 'Now users get verified easily.' The project was completed in 4 weeks at a low cost, and the app has now issued over 10,000 certificates.

Ready to Integrate Onfido & AML Solutions?

If you are looking to integrate Onfido SDK or AML solutions like ComplyAdvantage into your applications, our expert team is here to help. Contact us today to secure your platform with trusted identity verification and advanced AML compliance.

Let's Work Together!

Mean Stack Development

Mean Stack Development

Vue JS Development

Vue JS Development

Javascript Development

Javascript Development

React JS Development

React JS Development

Angular JS Development

Angular JS Development

Next JS development

Next JS development

Java Development

Java Development

Python Development

Python Development

Django Development

Django Development

Cherrypy Development

Cherrypy Development

C# Development

C# Development

ASP.NET Development

ASP.NET Development

NodeJS Development

NodeJS Development

Laravel Development

Laravel Development

CodeIgniter Development

CodeIgniter Development

Zend Development

Zend Development

Ruby on Rails Development

Ruby on Rails Development

CakePHP Development

CakePHP Development

PHP Website Development

PHP Website Development

Symfony Development

Symfony Development

Drupal Development

Drupal Development

Joomla Development

Joomla Development

Wordpress Development

Wordpress Development

.NET Nuke Development

.NET Nuke Development

Kentico

Kentico

Umbraco

Umbraco

.NET MAUI Development

.NET MAUI Development

Xamarin Application Development

Xamarin Application Development

iOS Application Development

iOS Application Development

Android Application Development

Android Application Development

Android Wear App Development

Android Wear App Development

Ionic Development

Ionic Development

Universal Windows Platform (UWP)

Universal Windows Platform (UWP)

Kotlin Application Development

Kotlin Application Development

Swift Application Development

Swift Application Development

Flutter Application Development

Flutter Application Development

PWA Application Development

PWA Application Development

Offshore Software Development

Offshore Software Development

Custom Application Development

Custom Application Development

Front-End Development

Front-End Development

Full Stack Development

Full Stack Development

AI & Machine Learning

AI & Machine Learning

Custom CRM Solutions

Custom CRM Solutions

Flask Software Development

Flask Software Development

Electron JS Development

Electron JS Development

ChatGPT Development

ChatGPT Development

Magento Development

Magento Development

Magento 2.0 Development

Magento 2.0 Development

Magento Enterprise

Magento Enterprise

Shopping Cart Development

Shopping Cart Development

Prestashop Development

Prestashop Development

Shopify Development

Shopify Development

Open Cart Development

Open Cart Development

WooCommerce Development

WooCommerce Development

BigCommerce Development

BigCommerce Development

NopCommerce Development

NopCommerce Development

Virto Commerce Development

Virto Commerce Development

AspDotNetStorefront Development

AspDotNetStorefront Development

RaspBerry Pi

RaspBerry Pi

Firmware Software Development

Firmware Software Development

ESP 32 Software Development

ESP 32 Software Development

Embedded Development

Embedded Development

Internet of Things

Internet of Things

Nordic Development

Nordic Development

.NET Application Development

.NET Application Development

Microsoft Dynamics CRM

Microsoft Dynamics CRM

VB .NET Development

VB .NET Development

Sharepoint Migration

Sharepoint Migration

ASP.NET Core Development

ASP.NET Core Development

ASP.NET MVC Development

ASP.NET MVC Development

AJAX Development

AJAX Development

Agile Development

Agile Development

Microsoft Bot

Microsoft Bot

Microsoft Blazor

Microsoft Blazor

Microsoft Azure Cognitive

Microsoft Azure Cognitive

HTML 5

HTML 5

UI/UX Design

UI/UX Design

Graphic Design

Graphic Design

Adobe Photoshop

Adobe Photoshop

XML Application Development

XML Application Development

Cloud Computing Solutions

Cloud Computing Solutions

Azure Cloud App Development

Azure Cloud App Development

AWS Development

AWS Development

Google Cloud Development

Google Cloud Development

SQL Programming Development

SQL Programming Development

MySQL Development

MySQL Development

MongoDB Development

MongoDB Development

Big Data

Big Data

Robotic Process Automation

Robotic Process Automation

Social Media Marketing

Social Media Marketing

Search Engine Optimization

Search Engine Optimization

QA Testing

QA Testing

Software Testing

Software Testing

Software Security

Software Security

Maintenance And Support

Maintenance And Support

I.T. Consulting Services

I.T. Consulting Services

Business Intelligence

Business Intelligence

YII Development

YII Development

Data Analysis

Data Analysis

Alexa Skills Development

Alexa Skills Development

On Demand App for Mobile repairing services

On Demand App for Mobile repairing services

On Demand App for Car Service Booking

On Demand App for Car Service Booking

On Demand App for Cleaning Services

On Demand App for Cleaning Services

On Demand App for Pharmacy

On Demand App for Pharmacy

On Demand Dedicated Developers

On Demand Dedicated Developers